Choosing the Right Home Loan

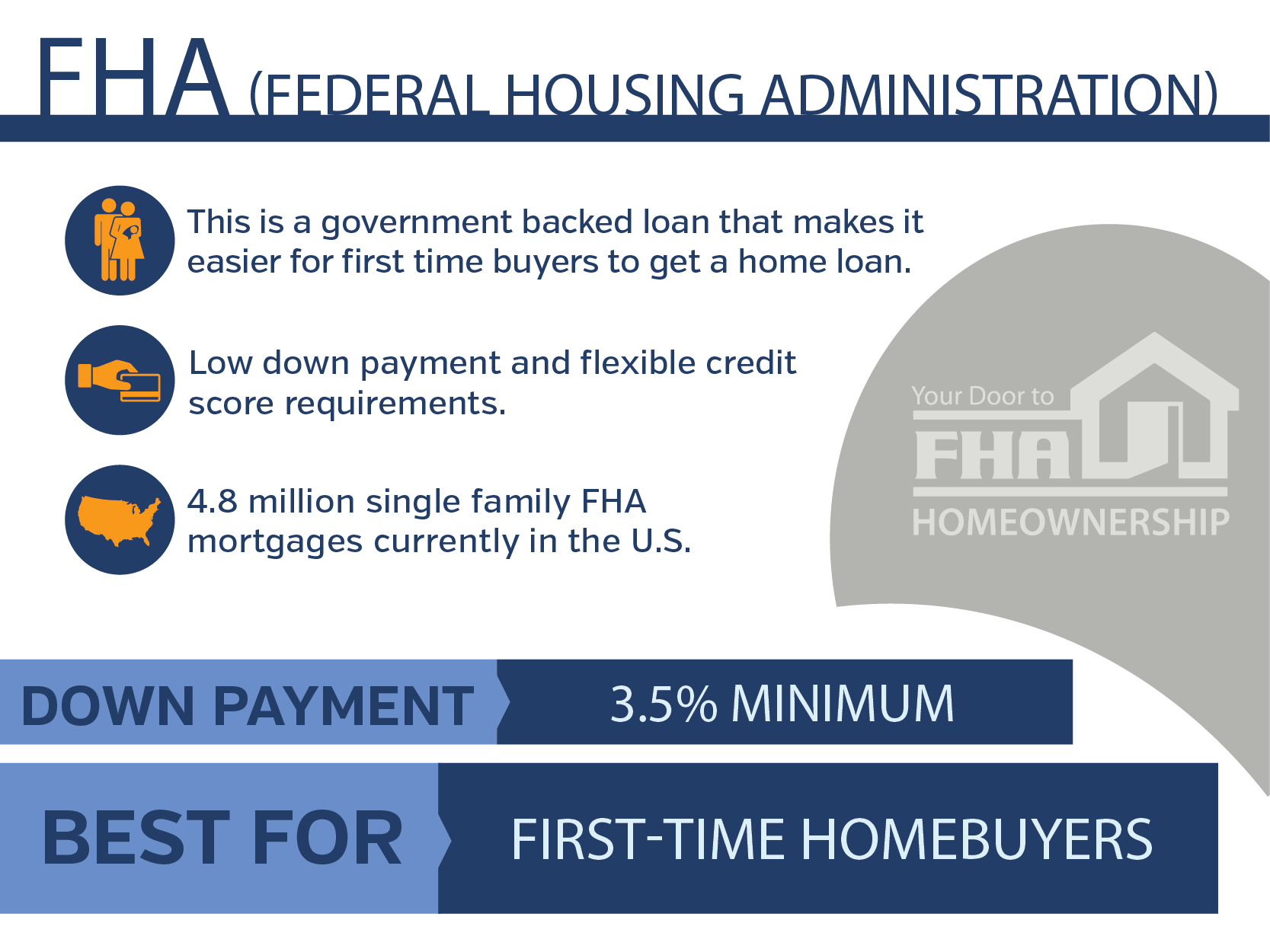

Buying a home will probably be the largest purchase you will make in your lifetime, and choosing the right mortgage loan will be a big decision. With so many different options, it's important to find the home loan that meets your financial goals. Below we'll break down some of the most popular loan types to help you better find the right fit for you. FHA home loans bring homeownership within reach for many buyers who may have a hard time getting approved with conventional lenders. While it may not be right for everybody, these home loans have very appealing features such as a low down payment, flexible credit score requirements, and the ability to use gifted money for closing costs.  A conventional home loan is commonly interchangeable with "conforming loans" since they are required to conform to Fannie Mae and Freddie Mac's underwriting requirements and loan limits. Most buyers choose conventional mortgages because they offer the best interest rates and loan terms, which usually result in a lower monthly payment.

A conventional home loan is commonly interchangeable with "conforming loans" since they are required to conform to Fannie Mae and Freddie Mac's underwriting requirements and loan limits. Most buyers choose conventional mortgages because they offer the best interest rates and loan terms, which usually result in a lower monthly payment.  Veterans Affairs mortgages, better known as VA loans, make it easier for veterans to finance their home. These loans are only available to military veterans and active military members. Spouses of military members who died while on active duty or as a result of a service-connected disability also can apply.

Veterans Affairs mortgages, better known as VA loans, make it easier for veterans to finance their home. These loans are only available to military veterans and active military members. Spouses of military members who died while on active duty or as a result of a service-connected disability also can apply.  If you prefer pastures over pavement, the U.S. Department of Agriculture has a mortgage program for you! The USDA home loan is eligible for rural and suburban homebuyers designed to improve the economy and quality of life in rural America. This program offers low-interest rates and no down payments, making it very accessible to potential homebuyers.

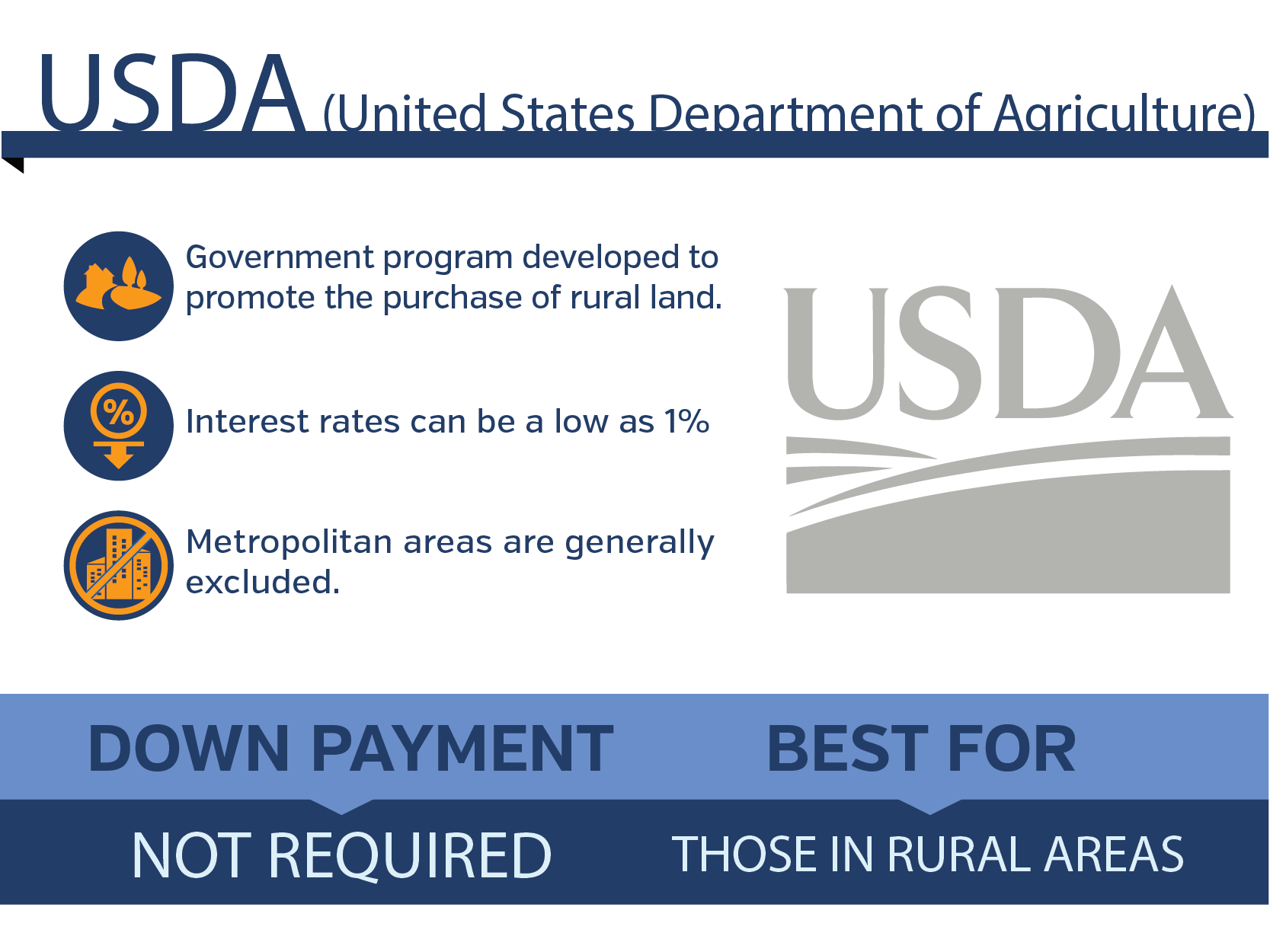

If you prefer pastures over pavement, the U.S. Department of Agriculture has a mortgage program for you! The USDA home loan is eligible for rural and suburban homebuyers designed to improve the economy and quality of life in rural America. This program offers low-interest rates and no down payments, making it very accessible to potential homebuyers.